Frequently Asked Questions

1. What are the Differences Between Exempt and Non-Exempt Salaried Employees in California?

Based on the chart, exempt employees are typically excluded from most legal protections in California, such as Overtime, Minimum Wage, and Meal and Rest Breaks. Non-Exempt employees must be covered by wage and hour laws in California. Wage and hour laws are protections for Non-exempt employees who are entitled to all protections that Exempt employees don’t receive.

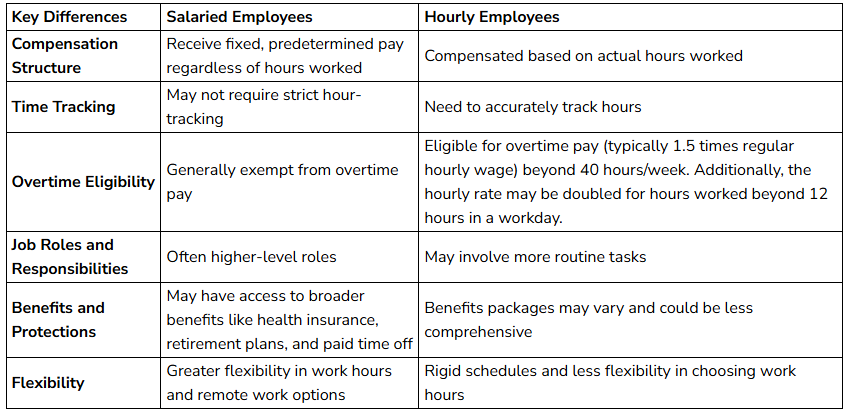

2. What are the Key Differences Between Salaried and Hourly Employees in California?

Salaried Employees are fixed incomes, regardless of hours worked, may not require clocking in and out, and this is usually given to upper management or higher position employees. Hourly employees are paid by each hour they work, it is crucial they keep an accurate time of their hours, are eligible for overtime and most employees are hourly.

3. How long can I wait to sue an employer for violation minimum wage?

In California, the statute of limitations for reporting a minimum wage violation is three years from the date the violation occurred. For violations based on an oral agreement, the reporting period is two years, while violations involving a written agreement have a four-year reporting period.

4. Is my employer allowed to deduct my wages?

No. Under California law, employers are required to pay employees for all hours worked and are prohibited from making certain types of deductions from an employee’s wages. Employers are generally prohibited from making deductions from an employee’s wages for items such as cash shortages, breakage, or other losses to the employer’s property. Employers are also prohibited from deducting wages for uniforms, tools, or other items that are primarily for the benefit of the employer.